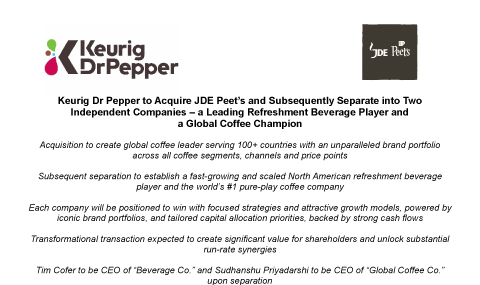

Combination with JDE Peet’s creates a stronger business

- Enduring North

American foundation - Steward of leading

Single serve ecosystem - Exciting growth &

Innovation pipeline

- Unparalleled

global scale - Leading regional

& local brands - Participation across all

major coffee profit pools

- Advantaged &

complementary portfolio - Enhanced revenue

potential - Clear & actionable cost

Synergies - Increased resilience

We’re creating two winning companies

that will be world class leaders.

Beverage Co.

Most agile North American beverage leader

Growth oriented North American challenger combines iconic brands with consumer-obsession and high-performing routes-to-market.

Future Global HQ: Frisco, Texas.

Global Coffee Co.

A Global Coffee Powerhouse

Building a global leader that will shape the future of coffee – fueled by innovation and scaled for impact.

Future global HQ: Burlington, Mass.

Future International HQ: Amsterdam.